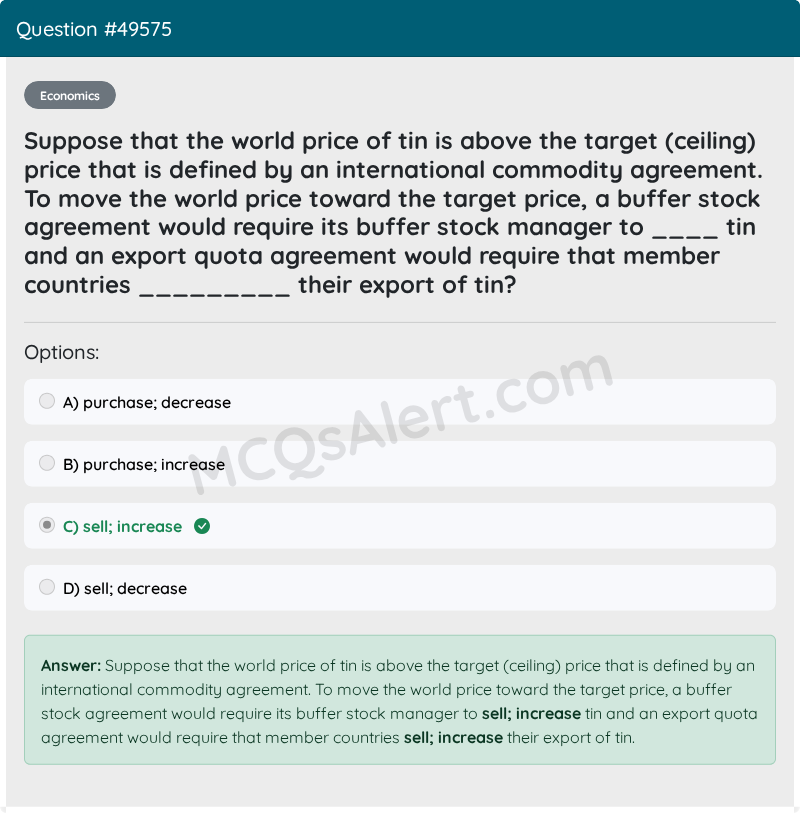

Question #49575

Suppose that the world price of tin is above the target (ceiling) price that is defined by an international commodity agreement. To move the world price toward the target price, a buffer stock agreement would require its buffer stock manager to ____ tin and an export quota agreement would require that member countries _________ their export of tin?

Options:

Answer:

Suppose that the world price of tin is above the target (ceiling) price that is defined by an international commodity agreement. To move the world price toward the target price, a buffer stock agreement would require its buffer stock manager to sell; increase tin and an export quota agreement would require that member countries sell; increase their export of tin.

Question Screenshot

Economics Related Questions

-

Q1.One percentage decrease in unemployment is associated with two percentage points of additional growth in real gdp is called?

-

Q2.Who is called the father of Economics?

-

Q3.For economists, the word “utility” means:

-

Q4.In economics, the pleasure, happiness, or satisfaction received from a product is called ______?

-

Q5.When economists say that people act rationally in their self interest, they mean that individuals _______?

-

Q6.According to Emerson: “Want is a growing giant whom the coat of Have was never large enough to cover.” According to economists, “Want” exceeds “Have” because:

-

Q7.According to economists, economic self-interest:

-

Q8.When entering a building, Asim diverts his path to go through an open door rather than make the physical effort to open the closed door that is directly in his path. This is an example of:

-

Q9.Resources in an economy ?

-

Q10.The sacrifice involved when you choose a particular course of action is called the ?

Category

Test Your Knowledge

Want to practice more questions like this? Take a quiz in this category!

Take a Quiz